ProHealth Prime, It’s Just Better!

It’s not just Health Insurance, it’s HealthCare insurance!

It covers expenses beyond hospitalization. Doctor consultations, laboratory test and pharmacy make up for significant portion of our healthcare expenses. The Wellness feature fetches you rewards based on the number of steps taken per day towards better health maintenance i.e. premium savings based on the steps you have walked per day.

Supreme Bonus

Guaranteed Cumulative Bonus of 100% of Base Sum Insured each year subject to a max of 800% of the Base Sum Insured, over and above the base Cumulative Bonus.

Covers non-medical expenses

No surprise bills in your hospitalization ensuring 100% of claim. ProHealth Prime takes care of your non-medical expenses. Syringes, hand gloves, even registration charges and so many other things which are neither medicines, nor consultancy, nor diagnostics and yet the expenses which form significant part of hospitalization charges.

Switch it off when you don’t need it

For the first time ever, you can switch off your cover when you won’t be needing it, like while abroad, for a month & get a discount on the next premium.

Choice of Any Room category

ProHealth Prime gives you complete peace of mind by allowing you to opt for “Any room” category, suite or above, as you deem fit.

Unlimited Restoration, for Real !!!

Your ProHealth Prime coverage restores to 100% of Sum Insured unlimited times if at any point, you are short of coverage. And that’s for both related and unrelated illnesses / injuries. Applicable from 2nd claim onwards.

Annual Health Check up

From 1st year onwards for all the adults insured to take the utmost care of your health, not just in illness but in wellness too.

And yes, Pre Existing Diseases ARE Covered

There is only a 90-day waiting period for claiming the expenses in case of hospitalization for illnesses such as asthma, diabetes, hypertension, dyslipidemia, & obesity related conditions. Other PED’s as per mentioned in Annexure.

1 Year Premium Waiver

When you go through the saddest moments and need the financial support, we ensure insurance premium is not the burden, to you and your family. If diagnosed with any of the listed Critical Illnesses or in an unfortunate event of Accidental Death, we waive off one year renewal policy premium so you and your family stay protected throughout.

Prohealth Prime Features

Pre, Post & In-patient Hospitalization

Get cover up to Sum Insured for pre, post, & in-patient hospitalization – for 60 days before & 180 days after the hospitalization in Protect & Advantage Plans, and for 30 days before & 60 days after the hospitalization in the Active Plan.

Room Accommodation

Get a single private room with AC & ICU room up to Sum Insured for Protect and Advantage plan. If the Sum Insured is equal to ₹3L, then the hospital room is covered up to 1% of the base cover amount for active plan.

Outpatient Expenses

Enjoy cashless cover up to ₹50K per year for pharmacy, consultations, diagnostics, including dental and vision, only in the Advantage Plan. pharmacy expenses will be covered up to 20% of opd limit.

Daily Hospital Cash

Get daily hospital cash as per your Sum Insured up to 1k per day, maximum up to 7k.

Air Ambulance

Protect & Advantage Plan users can get Air Ambulance cover up to ₹10L.

Comprehensive Cover

HIV/AIDS and STD covered up to Sum Insured, Modern and Advanced treatment covered up to 50 % of Sum Insured for active plan .

For Protect and Advantage plan- HIV AIDs covered up to Sum Inusred.

Modern and Advanced treatments

For Sum Insured less than ₹5 Lacs: Up to 50% of Sum Insured

For Sum Insured ₹5 Lacs and above: Up to Sum Insured

Entry Age

For Protect & Advantage Plans, children from 91 days to 25 years are eligible for family floater & adults who are 18+ years are eligible for the individual type policy. For the Active Plan, children from 91 days to 17 years & adults from 18 years to 70 years are eligible for individual policy type.

Payment Options and Tenure

Pay a single premium each year or divide it into half-yearly, quarterly, or monthly payments, along with policy tenure of your choice – either 1, 2, or 3 years.

Relationships covered

You can buy this plan for yourself & your immediate family, including grandparents & grandchildren. You can also avail this for your extended family including in-laws, uncles, aunts, nephews & nieces.

Bariatric Surgery Cover

Cover up to 5 lac for protect and advantage plan.

Road Ambulance & Donor Expenses

Road ambulance & donor expenses are covered up to the Sum Insured.

Plan Comparison

| PLAN NAME | ProHealth Prime Protect |

ProHealth Prime Advantage |

ProHealth Prime Active |

|---|---|---|---|

| Sum Insured | 3 Lacs - ₹ 100 Lacs | 5 Lacs- ₹ 100 Lacs | 3 Lacs- ₹ 15 Lacs |

| Room Accommodation | Single Private AC Room ICU: Up to SI |

Single Private AC Room ICU: Up to SI |

SI =₹ 3Lacs: 1% of Base SI SI>=₹ 5Lacs: Single Private AC Room ICU: Up to SI |

| Pre - Hospitalization | 60 days; Up to SI | 60 days; Up to SI | 30 days; Up to SI |

| Post - Hospitalization | 180 days; Up to SI | 180 days; Up to SI | 60 days; Up to SI |

| Day Care Treatment | Up to SI | Up to SI | Up to SI |

| Domiciliary Hospitalization | 10% of SI | 10% of SI | 10% of SI |

| Road Ambulance | Up to SI | Up to SI | Up to SI |

| Donor Expenses | Covered up to the Sum Insured

• Pre & Post Hospitalization expenses (Up to 30 days each) of the donor. • Cost towards donor screening once in a Policy year for successful transplant. • Complications arising during hospitalization or up to 30 days from date of discharge - Covered up to 25% of SI subject to maximum of ₹2 Lacs, Over and above SI. We will not cover expenses towards the Donor in respect of cost associated to the acquisition of the organ. |

Covered up to the Sum Insured

• Pre & Post Hospitalization expenses (Up to 30 days each) of the donor. • Cost towards donor screening once in a Policy year for successful transplant. • Complications arising during hospitalization or up to 30 days from date of discharge - Covered up to 25% of SI subject to maximum of ₹2 Lacs, Over and above SI. We will not cover expenses towards the Donor in respect of cost associated to the acquisition of the organ. |

Up to SI |

| Restoration of Sum Insured | Unlimited times for related/unrelated illnesses | Unlimited times for related/unrelated illnesses | Unlimited times for unrelated illnesses |

| AYUSH Treatment | Up to SI | Up to SI | Up to SI |

| Air Ambulance Cover | Up to SI, subject to a maximum of ₹ 10Lacs | Up to SI, subject to a maximum of ₹ 10Lacs | Not Applicable |

| Bariatric Surgery Cover | Up to SI, subject to a maximum of ₹ 5Lacs Waiting Period: 36 months |

Up to SI, subject to a maximum of ₹ 5Lacs Waiting Period: 36 months |

Not Applicable |

| Outpatient Expenses | Not Applicable | Covered up to maximum of ₹ 20,000/30,000/50,000 per policy year, through cashless basis - Consultations, Prescribed diagnostics & pharmacy. A limit of up to 20% of the OPD limit shall apply on Pharmacy expenses. |

Not Applicable |

| Convalescence Benefit | Not Applicable | Not Applicable | For SI>=₹ 5 lacs: ₹ 30,000 for hospitalization >=10 days, to be paid as lump sum |

| Daily Cash for Shared Accommodation | Per Hospitalization: For SI up to ₹ 10 Lacs: ₹ 800 p.d. max ₹ 5600 For SI above ₹ 10 Lacs: ₹ 1000 p.d. max ₹ 7000 Cover triggers post 48 hours of hospitalization and payable from 1st day |

Per Hospitalization: For SI up to ₹ 10 Lacs: ₹ 800 p.d. max ₹ 5600 For SI above ₹ 10 Lacs: ₹ 1000 p.d. max ₹ 7000 Cover triggers post 48 hours of hospitalization and payable from 1st day |

Per Hospitalization: For SI from ₹ 5 Lacs to ₹ 10 Lacs: ₹ 800 p.d. max ₹ 5600 For SI above ₹ 10 Lacs: ₹ 1000 p.d. max ₹ 7000 Cover triggers post 48 hours of hospitalization and payable from 1st day |

| Health Check Up | Annually from 1st year onwards, for all adults insured. Limits / Test basis opted SI, offered through Network only. | Annually from 1st year onwards, for all adults insured. Limits / Test basis opted SI, offered through Network only. | Available only if Wellness Program is removed from the base plan. Applicable once every 3rd policy year. Available as optional cover. |

| Domestic Second Opinion | Available for 36 listed Critical Illnesses | Available for 36 listed Critical Illnesses | Available for 36 listed Critical Illnesses |

| Tele- Consultation | Unlimited | Unlimited | Unlimited |

| Cumulative Bonus | Guaranteed Cumulative Bonus of 25% of Base SI each year subject to a max of 200% of the Base SI, irrespective of claims | Guaranteed Cumulative Bonus of 25% of Base SI each year subject to a max of 200% of the Base SI, irrespective of claims | Cumulative Bonus: 10% of the expiring Base SI for every year subject to a maximum of 100% of Base SI |

| Switch Off Benefit | Switch off the cover after 1 year for a maximum period of 30 days and get discount in premium during subsequent renewal. | Switch off the cover after 1 year for a maximum period of 30 days and get discount in premium during subsequent renewal. | Not Applicable |

| Wellness Program | Earn rewards up to 20% of base premium through completing Healthy Life Management Program | Earn rewards up to 20% of base premium through completing Healthy Life Management Program | Earn rewards up to 15% of base premium through completing Condition Management Program |

| Premium Waiver benefit | Waives off next one year renewal policy premium upon occurrence of any of the listed contingencies | Waives off next one year renewal policy premium upon occurrence of any of the listed contingencies | Waives off next one year renewal policy premium upon occurrence of any of the listed contingencies |

| OPTIONAL PACKAGES | |||

| Enhance Plus | 1. Room Accommodation - upgrade to "Any Room" 2. Health Maintenance Benefit of up to ₹ 3000 per Policy Year 3. Maternity & New Born (Including 1st year vaccination expenses) - 10% of SI per delivery subject to a maximum of ₹ 1Lac |

Not Applicable | Not Applicable |

| Enhance | Not Applicable | 1. Room Accommodation - upgrade to "Any Room" 2. Maternity & New Born (Including 1st year vaccination expenses) - 10% of SI per delivery subject to a maximum of ₹ 1Lac |

Not Applicable |

| Freedom (Only for Indian Residents) | 1. Room Accommodation - upgrade to "Any Room" 2. Worldwide Emergency Hospitalization with Outpatient Cover (including Accidental Hospitalization) Up to SI; Over and above the Base SI |

1. Room Accommodation - upgrade to "Any Room" 2. Worldwide Emergency Hospitalization with Outpatient Cover (including Accidental Hospitalization) Up to SI; Over and above the Base SI |

Not Applicable |

| Assure (Applicable for ₹ 3Lacs/₹ 4Lacs & ₹ 5Lacs Sum Insured) | 1. Room rent - Up to 1% of Sum Insured per day; ICU - Up to 2% of Sum Insured per day 2. Modern and Advanced Treatments - Covered up to 10% of Sum Insured 3. Disease specific sub-limits applicable |

Not Applicable | Not Applicable |

| OPTIONAL COVERS | |||

| Non Medical Items (Non Payables) |

Up to SI as a part of Base SI offering | Up to SI as a part of Base SI offering | Up to SI as a part of Base SI offering |

| Deductible | ₹ 10K or ₹ 25K | Not Applicable | Not Applicable |

| Infertility Treatment (Option available with Enhance / Enhance Plus - Optional Packages, Applicable if base SI>= ₹ 7.5lacs) |

Infertility treatment limited to IUI and/or IVF - Coverage up to ₹ 2.5Lacs, over and above the Maternity limit - Waiting period of 36 months |

Infertility treatment limited to IUI and/or IVF - Coverage up to ₹ 2.5Lacs, over and above the Maternity limit - Waiting period of 36 months | |

| Personal Accident Cover (Fixed Benefit) | 2 times of SI subject to a maximum of ₹ 50Lacs | 2 times of SI subject to a maximum of ₹ 50Lacs | Not Applicable |

| Cumulative Bonus Booster (For SI ₹ 5Lacs and above) |

50% of SI per policy year, subject to a maximum of 200% of SI | 50% of SI per policy year, subject to a maximum of 200% of SI | Not Applicable |

| Worldwide Accidental Emergency Hospitalization Cover | Not Applicable | Not Applicable | Up to SI; Over and above the Base SI |

| ManipalCigna Critical Illness Add On Cover (Critical Illness Benefit Rider) |

Any available SI options under Critical Illness Benefit Rider subject to the maximum of the Base SI | Any available SI options under Critical Illness Benefit Rider subject to the maximum of the Base SI | Not Applicable |

| Eligibility | |||

| PED Waiting Period | Up to SI ₹ 5Lacs - 36 months For SI >= ₹ 7.5Lacs - 24 months |

Up to SI ₹ 5Lacs - 36 months For SI >= ₹ 7.5Lacs - 24 months |

90 days for Asthma, Diabetes, Hypertension, Dyslipidaemia, Obesity related conditions For all other conditions - 24 months |

| Policy type | Individual / Multi Individual /Family Floater | Individual / Multi Individual /Family Floater | Individual / Multi Individual |

Discounts made better

Standing Instruction Discount

Standing Instruction Discount: Get a discount of 3% on the renewal premium, if it is received via a Standing Instruction.

Long term discount

Avail a long term discount of 7.5% on the total premium for a one-time 2 year policy term payment and enjoy a 10% on the total premium for a one-time 3 year policy term payment

Family Discount

For multi-individual policies within a family comprising 2 or more members, enjoy a discount of 20% on the total premium.

No claim bonus

Policy holder will get 1% discount on the renewal premium if no claim has been made during the expiring policy tenure.

Claiming Process done easy

1800-419-1159 (toll-free number) Cigna@mediassistindia.com

Start your simple settlement process here.

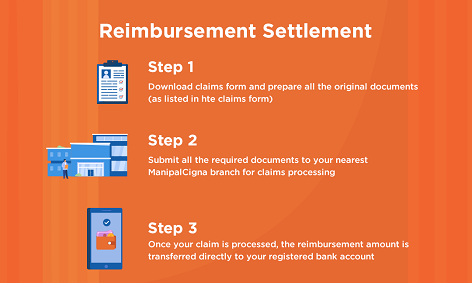

Reimburse your medical bills in three easy steps.

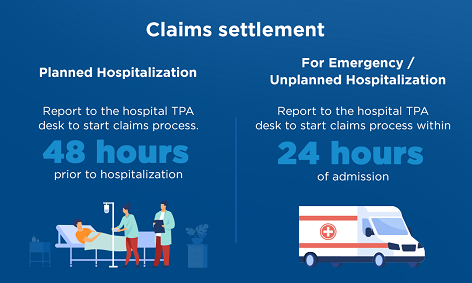

Get cashless settlement easily whether for planned or unplanned hospitalization.

Assured claims granted in 90 minutes. Check claim status easily.

Frequently Asked Questions

Why should one buy ProHealth Prime Product?

ManipalCigna ProHealth Prime offers high Sum Insured to cover Hospitalisation expenses, Pre & Post Hospitalisation expenses & day care treatments. It also provides cover for Individuals with existing conditions such as Asthma, Hypertension, Diabetes, Obesity, Dyslipidaemia etc.

It is a comprehensive product with very innovative and beneficial covers such as coverage for Non-Medical Expenses, Option to choose ‘Any room’ category, Switch off, Premium waiver benefit, Unlimited restoration of Sum Insured, Guaranteed Cumulative Bonus, Discount on Network Providers and much more.

There are optional packages and optional covers which makes the product highly customizable and making it suitable for all the customer segments.

What do we mean by Non-medical expenses?

Non-medicals expenses are expenses incurred during hospitalization on items such as syringes, urine container, and registration charges etc. which are generally not covered in most of the insurance products. But we have heard you and we ensure 100% coverage for your expenses. Hence we say, everything is covered!

Did you ever know that one can switch off the Insurance cover like you switch off lights, fans when you don’t use them?

Switch off feature lets you switch off the cover for upto 30 days in a Policy Year, if you are travelling abroad and allows you to save premium. You have to just intimate us the dates of your travel and we shall take care of the rest.

Why do we say we are by your side always when in life you meet with an unfortunate event?

When you and your family goes through the saddest lows of life and when you are in need of the financial support, we ensure Insurance Premium does not become a burden to you and you and your family stays protected throughout. Our Premium waiver benefit will waive off the 1 year renewal premium if you (Primary Insured cum Proposer) are diagnosed with any of the listed Critical Illnesses or in case of an unfortunate death due to an accident.

Are you wondering which room should you opt while getting admitted in the hospital?

Worry not now! We understand you and ProHealth Prime will ensure you have complete peace of mind by allowing you to opt for “Any room” category without any limits or deductions.

One is never sure how much coverage is enough and what can you do if the entire Sum Insured gets exhausted in a year due to multiple hospitalizations and claims?

We hear you and acknowledge this concern. With ProHealth Prime we restore 100% of Sum Insured after 1st claim in a policy year, if at any point in time you are short of the coverage. This is possible in case of both related and unrelated illnesses and accidents.

We do not just believe in covering hospitalization expenses. What do we mean by that?

With the coverage for OPD expenses and simplified wellness offerings, we have gone beyond Hospitalization. OPD contributes to out of pocket expenses for customers which include doctor consultations, diagnostics and pharmacy. With wellness feature, one can accumulate rewards based on steps taken i.e. the more you walk the more you save on premium by availing discount.

We provide more at the same price. How is that?

With the option to avail Cumulative Bonus Booster, you avail 50% of additional coverage every year up to maximum of 200% instead of 25% each year.

What is No claim bonus?

Policy holder will get 1% discount on the renewal premium if no claim has been made during the expiring policy tenure.