Lifetime Health

Unlimited Restoration of Sum Insured

If the sum insured is insufficient / exhausted due to previous claims made during the policy year, then the plan restores the Sum Insured to additional 100% multiple times in a Policy Year for unrelated illnesses. Multiple Restoration is available in a Policy Year, for unrelated illnesses, in addition to the Sum Insured opted. The restored amount will be available for claim towards expenses covered in India only

Premium Waiver Benefit

Renewal Premium for one Policy Year will be paid by us, if the Proposer is diagnosed with any of the listed Critical Illnesses or in case of Accidental Death, Permanent Total Disablement, Permanent Partial Disablement of the Proposer, provided the Proposer is also an Insured Person in the same Policy.

“For complete details on the product feature please refer Term and Condition of the product”

Portability Continuity

Get Continuity benefit on the entire opted sum insured for those with existing health cover of Rs. 10 Lacs and above

Cumulative Bonus+

Guaranteed Cumulative Bonus at 15% every year till the time you renew your policy with us.

(Applicable on India Sum insured of your lifetime health policy)

Worldwide Medical Emergency Hospitalization Cover+

Coverage for medical emergencies when you are abroad under inpatient hospitalization and day care. This also covers global ambulance and air ambulance services with post hospitalization up to 30 days.

Adult Health Check-up

This benefit will be available once a Policy Year starting from the first Policy Year provides a Health Check-up facility for all Insureds aged 18 years or above at the inception of the Policy Year at our Network Hospitals..

Global Ambulance Cover

Under Global plan, expenses incurred towards transportation of the Insured Person by a Road Ambulance or an Air Ambulance to move the Insured Person to and from healthcare facilities during an Emergency for opted Major illness/es, within the opted Area of cover. Air Ambulance is available once in a Policy Year for each Insured Person.

Coverage

Coverage is provided from Rs. 50 lakhs to Rs. 3 Crores to protect you and your loved ones.

Hospitalization Expenses

Hospital expenses are as per eligible room category, for admission longer than 24 hours, up to the full Sum Insured, where hospitalization is in India, for India Plan.

Day Care Treatment

All Day Care Treatments which are availed in India will be covered up to the full Sum Insured.

Pre – hospitalization

Pre-hospitalisation medical expenses incurred in India preceding the date of Hospitalization and up to 60 days and up to the full Sum Insured.

Post – hospitalization

Post-hospitalisation medical expenses incurred in India up to 180 days immediately after discharge from the hospital and up to full Sum Insured.

AYUSH Cover

Up to full Sum Insured, for AYUSH (Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homeopathy) treatment availed in India.

Road Ambulance Cover

Expense incurred on availing Road Ambulance services in India, up to full Sum Insured.

Donor Expenses

Up to full Sum Insured, for expenses incurred in India.

Domiciliary Expenses

Up to 10% of Sum Insured, for domiciliary expenses incurred in India.

Robotic and Cyber knife Surgery

Up to full Sum Insured, for robotic and cyber knife surgery treatment availed in India.

Modern and Advanced Treatments

Up to full Sum Insured, for Modern treatments listed in the Policy.

Mental Care Cover

Up to full Sum Insured, for treatment availed in India.

Plan Comparison

| What am I covered for | India Plan | Global Plan |

|---|---|---|

| Sum Insured1 (INR) | 50 Lacs/ 75 Lacs/ 100 Lacs/ 150 Lacs/ 200 Lacs/ 300 Lacs | 50 Lacs/ 75 Lacs/ 100 Lacs/ 150 Lacs/ 200 Lacs/ 300 Lacs |

| Sum Insured2 (INR) | No | 50 Lacs/ 75 Lacs/ 100 Lacs/ 150 Lacs/ 200 Lacs/ 300 Lacs |

| Major Illness (For coverages outside India) |

No | Option to select the Major Illness/es for which coverage is required under Covers 16 to 25.

|

| Area of Cover (For coverages outside India) |

No | Option to select any one as Area of Cover (AOC), applicable to Covers 16 to 25: Worldwide Worldwide excluding USA and Canada |

| Cover/s | India Plan | Global Plan |

| 1. Hospitalization Expenses | Yes | Yes |

| 2. Day Care Treatment | Yes | Yes |

| 3. Pre – hospitalization | Yes | Yes |

| 4. Post – hospitalization | Yes | Yes |

| 5. AYUSH Cover | Yes | Yes |

| 6. Road Ambulance Cover | Yes | Yes |

| 7. Donor Expenses | Yes | Yes |

| 8. Domiciliary Expenses | Yes | Yes |

| 9. Adult Health Check-up | Yes | Yes |

| 10. Robotic and Cyber Knife Surgery | Yes | Yes |

| 11. Modern and Advanced Treatments | Yes | Yes |

| 12. HIV/AIDS and STD Cover | Yes | Yes |

| 13. Mental Care Cover | Yes | Yes |

| 14. Restoration of Sum Insured | Yes | Yes |

| 15. Premium Waiver Benefit | Yes | Yes |

| 16. Global Hospitalization for Major Illness | No | Yes |

| 17. Global Pre- hospitalization | No | Yes |

| 18. Global Post- hospitalization | No | Yes |

| 19. Global Ambulance Cover | No | Yes |

| 20. Medical Evacuation | No | Yes |

| 21. Medical Repatriation | No | Yes |

| 22. Repatriation of Mortal Remains | No | Yes |

| 23. Global Travel Vaccination | No | Yes |

| 24. Global Robotic and Cyber Knife Surgery | No | Yes |

| 25. Global Modern and Advanced Treatments | No | Yes |

| Optional Packages | ||

| Health+ | Yes | Yes |

| Women+ | Yes | Yes |

| Global+ | No | Yes |

| Waiting periods | ||

| Pre-existing Disease waiting Period | 24 Months | 24 Months |

| 30 days waiting period | Yes | Yes |

| Specified disease/procedure waiting periods | 24 Months | 24 Months |

| Add On Cover (Rider) | ||

| Critical Illness Add On Cover | Yes | Yes |

Discounts made better

Loyalty Discount

5% discount from 4th policy year to 7th policy year. 10% discount from 8th year onwards.

Long Term Discount

7.5% for 2 years and 10% for 3 years policy term respectively if premium is paid in single premium payment mode.

Family Discount

15% for covering 2 or more family members under single individual policy.

Online Renewal Discount

A discount of 3% p.a. on the premium from next renewal, if the premium is received through NACH or Standing Instruction (where payment is made either by direct debit of bank account or credit card.)

Claiming Process done easy

1800-419-1159 (toll-free number) Cigna@mediassistindia.com

Start your simple settlement process here.

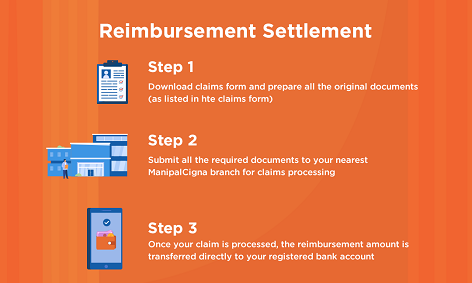

Reimburse your medical bills in three easy steps.

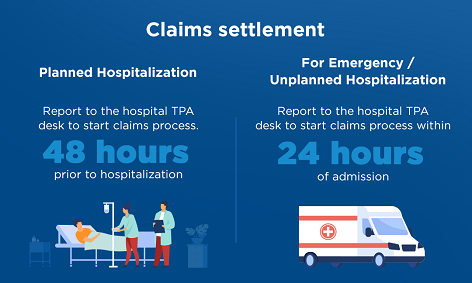

Get cashless settlement easily whether for planned or unplanned hospitalization.

Assured claims granted in 90 minutes. Check claim status easily.

Health 360 OPD

Get OPD consultations for every ailment without any worry

Secure doctor consultation coverage including Dental and Vision consultations, through the Network Medical Practitioner, up to the Outpatient Sum Insured as opted under this rider.

Don’t compromise on diagnostics tests

In addition to doctor consultation get covered for diagnostic tests including Dental and Vision diagnostics, wherever prescribed by the Network Medical Practitioner, up to the Outpatient Sum Insured as opted under this rider.

Medicines & drugs will no longer burn a hole in your pocket

In addition to doctor consultation, prescribed diagnostic get covered for expenses incurred for medicines prescribed by the Network Medical Practitioner for up to 20% of the Outpatient Sum Insured.

Health 360 Shield

Let go of the worry of paying for Non-Medical items

We’ve got your Non-Medical items covered up to the Sum Insured opted under the base policy, in case of In-patient Hospitalization and/or Day Care Treatment.

Coverage for Durable Medical Equipment

You also get coverage for Durable Medical Equipment up to ₹ 1 Lac in case, prescribed during hospitalization or within 30 days post-discharge.

Health 360 Advance

Get your Sum Insured restored every time

Advance restores up to 100% of sum insured unlimited times so you don’t fall short of coverage for both related and unrelated illnesses/ injuries. Applicable from second claim onwards.

Upgrade to the room of your choice

You shall be eligible to upgrade the room type category eligibility under the base policy to “Any room” category in a hospital.

Coverage on Air Ambulance

Get transportation expenses to the nearest hospital/ healthcare facility in case of life threatening condition demanding immediate attention. Air Ambulance facility is covered on a reimbursement basis, up to Sum Insured opted under the base policy subject to a maximum of ₹ 10 Lacs, in addition to base policy Sum Insured.

Added Benefits

+Guaranteed Cumulative Bonus Every year

Guaranteed 15% increase of your base sum insured per year, irrespective of claims in your policy. Renew your policy with us and avail no capping on maximum accumulation for a lifetime.

(Applicable on Lifetime India Sum Insured)

+Emergencies are Covered Worldwide

Coverage for medical emergencies that can occur when you are abroad. Medical emergencies due to pre-existing conditions are also covered up to 25% of sum insured.

Coverage for Maternity Expenses

Maternity Expenses are covered up to Rs 1 Lac, covering up to 2 deliveries or medically necessary terminations.

Optional - Infertility Cover up to Rs. 2.5 Lacs for up to maximum two successful procedures.

Coverage for Surrogacy complications

Coverage for Surrogate mother for medical expenses towards complications arising out of pregnancy and covering post-partum delivery complications up to Rs 1 Lac.

Coverage for Oocyte Retrieval complications

Coverage for Oocyte Donor for medical expenses towards complications arising out of Oocyte retrieval, up to Rs 1 Lac.

Frequently Asked Questions

What do you mean by individual policy?

In case of an Individual policy, each Insured person under the policy will have a separate sum insured for them. Individual plans can be bought for self, lawfully wedded spouse (same or opposite gender), children, parents, siblings, parent in laws, grandparents and grandchildren, son in-law and daughter in-law, uncle, aunt, nephew and niece.

What do you mean by Family Floater policy?

In case of a floater cover, one family will share a single sum insured as opted.A floater plan can cover self, lawfully wedded spouse (same or opposite gender), children up to the age of 25 years, parents or parent in laws. A floater cover can cover a maximum of 2 adults and 3 children under a single policy. Combinations allowed under 2 Adults are: Self & Spouse or Father & Mother or Father-in-law & Mother-in-law.

What are the policy period options for ManipalCigna Lifetime Health?

You can buy the policy for one, two or three continuous years at the option of the Insured. One Policy Year shall mean a period of one year from the inception date of the policy.

What are the minimum and maximum entry ages for the Lifetime Health?

For children: 91 days (minimum) and 25 years (maximum)

For adults: 18 years (minimum) and 65 years (maximum)

What is the pre-existing disease waiting period for ManipalCigna Lifetime Health?

Pre-existing disease waiting period for ManipalCigna Lifetime Health is 24 months. That means, your pre-existing diseases declared at the time of policy purchase will be covered after 2 years subject to continuous renewals.